No longer can we preach on the benefits of Supply Chain Finance without considering sustainability and inclusivity, CSR, or ESG.

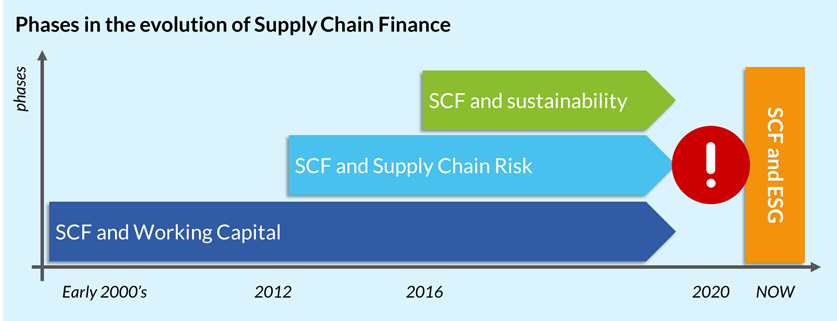

Supply Chain Finance (SCF) started more than 20 years ago. Its focus in the initial stages was strongly on working capital management. It was all about ‘unlocking liquidity’ in supply chains, lowering costs of debt, extending payment terms, providing early payments.

It worked. It made sense.

The financial crisis of 2008-2012 created an environment of low credit availability for most suppliers, a strong credit squeeze that exacerbated the need for programmes in the like of SCF. Within that period SCF boomed, becoming a well sought after solution in Europe and North America.

With SCF becoming mainstream and quite widespread, corporates naturally started to expand and transform what SCF was and what it was meant to do. Around 10 years ago, we saw SCF shifting towards becoming (also) a supplier risk management tool. It formally entered large corporates’ ‘Business Continuity Plans’ for their strategic suppliers, usually at low or no cost for the supplier on the rocks. Additionally, it began to be used as a tool for supply chain responsiveness and resilience: buyers used it to help smaller suppliers follow steep growth paths, or simply provide liquidity to critical suppliers through near-zero-day payment terms, which would be otherwise unattainable. From a working capital perspective, SCF entered the supply chain control room.

Soon after that, sustainability followed. In 2016, International Finance Corporation (IFC), together with PUMA, LEVI’s and NIKE, initiated the most renowned sustainability-linked SCF programme. The idea was simple: link the cost of SCF to suppliers’ sustainability ratings. It led to a whole new phase for SCF, in which it could drive positive change in buyers’ supply chains. Suddenly, SCF was no more just a tool in the buyer’s quiver for managing payment terms (or keeping risk under control), but it was now also linked to social responsibility discussions.

Everything changed when the world went upside down in 2020. The Coronavirus Pandemic, among many other things, substantially changed how SCF was perceived and used by companies. The equilibria within programmes shifted: supply chain resilience became, for many, a priority, and SCF started to play a more prominent role in securing strategic and critical suppliers. Supplier usage of SCF ramped up, and programme limits were tested as never before. But that, of course, was not the only major event shaping the SCF industry. In March 2020, Greensill bankrupted, ending its tenure as an SCF market leader. We have written extensively about this. This blow to the credibility and trustworthiness of the entire SCF industry, together with the shock of the pandemic and the resulting uncertainty and unreliability, worked as a ‘reboot’ moment for the SCF strategy of many corporates.

Such an evolution, and such a shock, lead to an obvious question: what kind of ‘SCF’ can we expect to emerge from the current context?

In our opinion, here at the SCF Community, we can answer this question by reading into three main trends:

1. Technology is increasingly used to support decision-making in supply chains. A data-driven approach to SCF (and supply chain management in general) is already evident, for example, in the increased usage of Artificial Intelligence to support the purchase of unapproved invoices or streamline, optimise and standardize payment term negotiations. This can open the door to more ‘social’ SCF programmes, in which small and medium enterprises (SMEs), or minority-owned suppliers are onboarded easily, despite their potential low volumes.

2. SCF is moving away from being a single instrument (read: reverse factoring) and more towards being ‘an approach’. As such, we see more focus on Purchase Order financing, Inventory Financing and Deep- tier Financing, often used to support social and environmental goals. For example, ‘deep-tier impact finance’ (DTIF) is being increasingly mentioned as a support tool to foster environmental and social positive change in low-income countries, where suppliers are unlikely to be connected directly to a large, credit-worthy buyer but where, for example, most of the scope 3 GHG emissions originate.

3. Buyers are rethinking their SCF strategies and, at the same time, regulatory bodies such as IASB, FASB, the SEC and many others are looking into driving more change in the direction of full transparency and fairness towards suppliers. The European Union, although more broadly, acted in this direction (through its UTP legislation). This legislation pushes towards more transparency within the SCF industry, which, if done properly, will provide a clearer form of governance to the entire industry.

Let’s be clear: SCF as a working capital tool is here to stay, as well as the role SCF plays in risk management. But what we expect to emerge from the current crisis is the SCF of E, S and G: Environment, Social and Governance. A more strategic view on SCF, with the potential to enhance its role within corporates, supply chains and society, rather than trap it to a payment term extension machine.

Excited by this vision, we have decided to develop a series of three whitepapers discussing SCF and its relation to ESG. Each of the three will address one of the ESG components: Environmental (such as SCF and Circular Economy) , Social (such as SME and minority inclusion in SCF programmes) and Governance (looking at corporate disclosure and current transparency in SCF).

You can expect insights deduced from interviews with corporates and top-level stakeholders in the SCF industry, snap-polls, academic research, top-notch data, and accumulated knowledge based on all the past forums and webinars on this topic.

More to follow. Stay tuned.

| White paper | Topics | Planned publication date |

| SCF+E | Environmental sustainability, Circular Economy and their link to SCF, use of supplier sustainability ratings in SCF | Feb 2022 |

| SCF+S | Supplier inclusiveness in SCF programmes | June 2022 |

| SCF+G | Governance of the SCF industry, transparency and disclosure for listed companies | April 2022 |