The automotive industry will surely remember the explosion of a chemical plant in Marl, Germany, on March 31st, 2012. A terrible accident, but one of many that happen almost every day around the world. Except that this one ended up halting global automotive production.

Halting global automotive production

The plant belonged to Evonik Industries, a relatively unknown (to the public) chemical processor that produced a polymer called ‘Nylon 12’, a key material for the food, textile, and healthcare industry, used essentially everywhere you need sterilized films and bags. It is also great for making gasoline-resistant tubes, the reason why it is used for fuel and brake lines in the automotive industry.

Many first-tier suppliers in the automotive industry were being supplied by Evonik Industries for their Nylon 12 needs. That resulted in the industry over-relying on one specific second-tier supplier.1

The situation was further exacerbated by the fact that the Evonik Marl factory theatre of the explosion was producing ‘CDT’, a key chemical component for Nylon 12 production, and it was supplying several other Nylon 12 producers (Evonik’s competitors) including Arkema, which at the time was the second biggest world producer of Nylon 12. Arkema had to halt production as well. Overnight, the industry lost more than 50% of the world’s production of a component that had a visible impact on the value of the final product, but that was almost impossible to substitute in the short term. As Evonik was (at the time!) essentially unknown to car brands, no specific contingency plan was in place for this occurrence.

The automotive industry learned a hard lesson: supply chain risk can sit anywhere in your supply chain, far beyond your immediate suppliers.

The Nexus Supplier

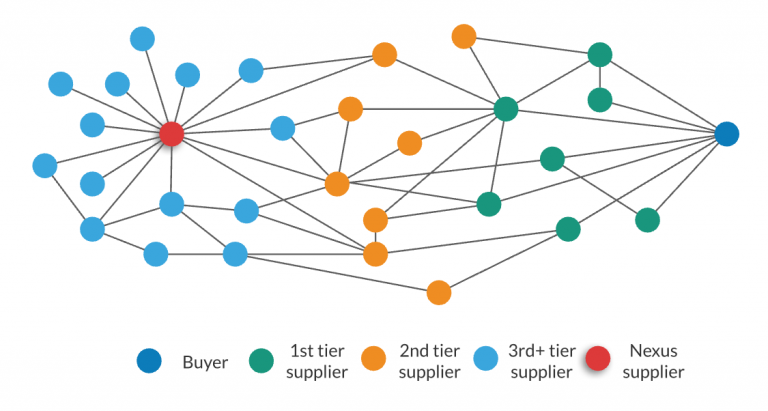

This idea of risk nested within the non-immediate supply chain is the concept of the ‘Nexus supplier’: suppliers that are critical, or strategic, or that happen to sit on a pile of critical information to spot disruption in advance, but are not immediately connected to the focal company.

Spotting and managing nexus suppliers is of course the dream of every supply chain risk manager. However, it might be less obvious than you might think. The complexity comes from the fact that a supply chain is very seldom neat and tidy as we think it is (see figure 1). Going beyond the first tier of supply implies an explosion of connections and complexity: thousands and thousands of suppliers, some of which are buying from customers, customers supplying from their suppliers’ suppliers, and so on. Which of them is your Nexus supplier?

Big data, resilience, and… Supply Chain Finance?

Here is where big data analytics can come in handy. By applying innovative data analytics techniques it is possible to spot and manage those suppliers. This is the new frontier of supply chain resilience: spot issues within your extended industrial network.

Here is also where Supply Chain Finance comes in. Think about the recent trends in using Supply Chain Finance (and, especially, reverse factoring) to reduce the risk of first-tier suppliers bankrupting. Large buyers, especially in COVID time, purposefully brought suppliers within their SCF program to allow them to get critical levels of liquidity very quickly and reduce their risk of bankruptcy.

The same reasoning can be easily extended to deep-tier suppliers: if a crisis hits Evonik, why not provide it with quick and easy access to liquidity in similar mechanisms to reverse factoring? It’s the concept of ‘deep-tier financing’, allowing suppliers beyond the first-tier to access liquidity. It’s something that is already up and running in China, and we discussed it in a publication from 2019.

Of course, this entire structure comes with its issues: where are the data? And what model can I apply? And what types of Nexus suppliers are there? How reliable is their identification?

Moreover, the SCF Community has launched a working group of multinationals on big data and supply chain resilience. It will meet regularly for sharing insights, knowledge, and best practices.

If you are an interested buyer or a supplier and would like to join this group feel free to reach out!