You can find our first viewpoint on the subject here and our white paper here.

Regulatory headwinds will likely lead to a higher number of disclosures of SCF programmes in the upcoming years. This – at least at face value – is good: transparency tends to be a positive trend, and SCF seems to need transparency, considering its recent history. The rationale is also clear: ‘good’ programmes survive, ‘bad’ programmes are challenged by the market, which would be much more effective to scrutinise them. ‘Bad’ programmes will then face reclassification risk, and thus an implicit risk of discontinuation. The question, of course, is how do we tell the difference?

Reclassification: a tangible risk?

Triggers for reclassification are well known, albeit relatively subjective (a common grievance for auditors); they include factors such as payment terms, tri-partite agreements, and buyers paying interest costs[1]. That said, most corporates are relatively savvy on how to manage their Supplier Financing programme (in the end, we are mainly talking about multi-billion corporates), they have years of experience in doing it and can avoid the most obvious pitfalls. The most critical point that remains is usually related to payment term extensions.

Clearly, it is not an easy task to assess the impact of such a change, with too many variables. As such, we are short on easy answers, but we do have a couple of considerations.

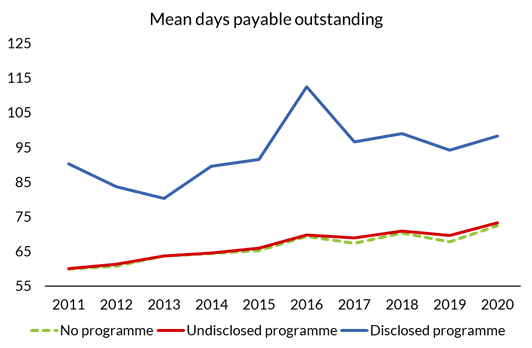

An interesting aspect that emerges from our analyses is the perceived payment behaviour of companies. In Figure 1., we grouped companies based on whether they have no Supplier Financing programme, an undisclosed Supplier Financing programme, or a disclosed one.

Figure 1: Book value of payment terms across corporates with disclosed, undisclosed and no Supplier Financing programmes.

While the difference in payment terms between disclosed programmes and all the other companies in the sample is strong and persistent throughout the years, the one between undisclosed and no programmes is essentially negligible. This can have different explanations:

- The number of corporates with a programme is higher than we assess, and we misclassify some of them as ‘without a programme’. Our analysis is based on public information. Although our investigation is in-depth, a company that keeps a real tight lid on its supplier financing programme will not be properly classified;

- Corporates with the most extreme payment behaviour are much more likely to be subject to disclosure and reclassification, already today, and they make up most of the ‘disclosed’ sample;

- Corporates with an undisclosed programme are keeping their accounts payable book value in line with the industry average, for example by paying a couple of invoices early before closing the books.

If we accept that all these factors play a role, we could argue that for a sub-sample of the ‘undisclosed’ group the ‘true’ payment behaviour is more similar to the disclosed one. For some of them, this implies a risk of reclassification that would put the volumes at risk of discontinuation.

Potential scenarios

That established we can likely expect four different scenarios to happen (not all of them are mutually exclusive, of course).

They are:

- Nothing happens: programmes are not discontinued, volumes remain largely unaffected by the new standards, the number of disclosures increases substantially;

- Volumes decrease, programmes don’t: corporates that face a risk of reclassification use the time available before standards kick into ‘de-risk’ their programmes, either by revisiting their average payment terms or by reducing the number of suppliers involved, which causes volumes to decrease;

- Programme numbers shrink: corporates that face the risk of reclassification will discontinue their programme altogether and revert to more ‘traditional’ forms of financing;

- Market shifts towards other instruments: corporates that face the risk of reclassification will shift part (or all) of their Supplier Financing volumes to different forms of SCF. Depending on their appetite between higher EBITDA margin or preserving long DPO, we might see an uptake of Dynamic Discounting (possibly with the use of third-party cash) and P-Cards or Credit Cards in general for working capital financing. In the right context, letters of credit might make an unexpected comeback into the mainstream.

We do not know which of these four (or an unidentified fifth one) scenarios will materialise. But out of these, our conclusion is twofold: first, concern about disclosure standards is, at least in part, a bad omen. This is not an ‘if you have nothing to hide, you have nothing to worry about’ argument, but an objective statement: mounting concern (considering the proposed standards) implies that the payment behaviour in Figure 1 is likely inaccurate and that programmes are indeed more material than what can be grasped through book values.

Second, transparency and disclosure are not a substitute for governance, they are a part of it. If our scenario 4 will materialise, wouldn’t the SCF industry find itself exactly at square one? It’s a never-ending game. The solution to this is a governance system that is proactive, long term and resilient. This requires leaders of the SCF industry to come forward and, together, self-determine a system that can stand the proof of time and promote virtuous sides of SCF, anticipating and facilitating the action of the regulator rather than reacting to it as an exogenous factor.

In summary, it would be, of course, helpful to approach disclosure more uniformly and transparently, both by auditors and rating agencies. However, as important as this can be, it is not the core issue of SCF governance. The relevance, rationale, and goals of SCF programmes are set by the market and the users. Leaders in the industry need to come forward and set the DNA for good practice in SCF.

The SCFC believes in this model.

If you wish to read our research on the topic of disclosure, you can freely access it here. The other two papers in the series include the ‘E’ of ESG, which focused on reflections around sustainability inclusion in SCF programmes (available here), and the ‘S’ of ESG, which will focus on inclusiveness in SCF programmes (available in June). Stay tuned!

[1] We analysed those in 2016 together with a group of auditors. If you don’t mind that it is a bit old, you can find it here.