Recent crises – whether it is the fallout of Greensill or the corona pandemic – have had a profound impact on the SCF industry. Most notably, regulators (and stakeholders in general) turned their heads decisively on what is happening in this arena. It is widely known that the SEC, in the United States, has asked large corporates, such as Boeing and Coca-Cola, to provide more information about their Supplier Financing programme. Concurrently, FASB and IASB have started projects to increase disclosure and transparency within the SCF industry. The triggering concern here is old, and yet unsolved: investors might not be aware of the impact of Supplier Financing for the corporate that they are analysing and be misled for example, on its financial exposure.

Besides informing investors about what’s going on in the accounts payable department of large corporates, such regulations and normative pressures have the undoubted advantage of increasing the transparency level of the entire SCF industry. Given the complexity of the SCF market (who is an SCF provider, exactly?) and its relative novelty (compared, for example, to the ancient factoring industry), there is little information on how pervasive Supplier Financing is. It seems like this is about to change.

At the SCF Community, we are supporters of transparency and visibility. Thus, excited and stimulated by incoming changes, we have decided to provide support to the entire industry by analysing the current status of disclosure and transparency on SCF worldwide. We have analysed a sample of companies, composed of the first 1000 companies in the FORBES list, from 2010 to 2020. We analysed whether they disclose or do not disclose Supplier Financing, and matched that with our internal list of programmes, built upon years of research, events, and simple observations, to see whether the same 1000 corporates (whether they disclose or not) have or do not have Supplier Financing.

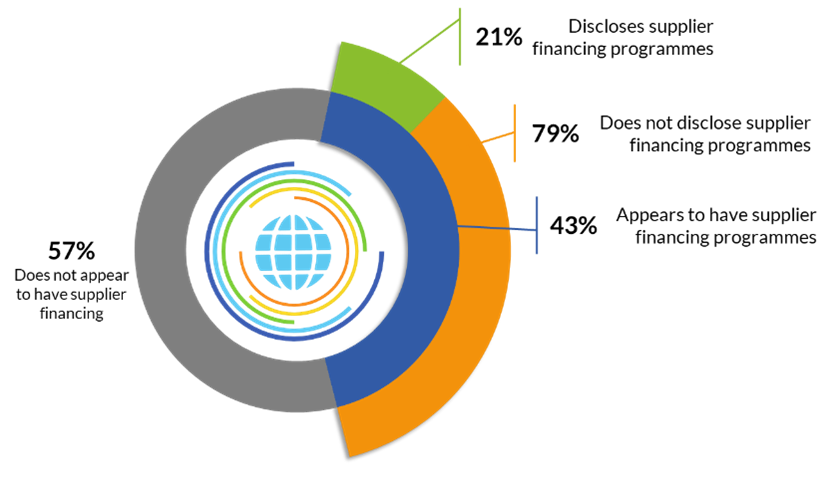

Our results are interesting, to say the least. As expected, disclosure is limited. To the best of our knowledge, roughly 40% of those 1000 corporates have Supplier Financing. Out of those, however, only 20% actually disclose it in their financial annual reports (see Figure 1).

Figure 1: Supplier financing programmes and their disclosure in our sample

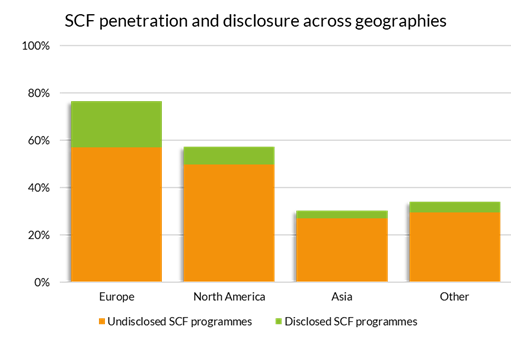

On a geographical level, it’s clear that Europe is strongly in the lead of the SCF market, as well as presenting the large share of disclosure. It’s a sign that Europe is likely the most mature market right now for Supplier Financing. A strong growth potential could be expected from Asia.

Figure 2: SCF penetration and disclosure across geographies

Looking at those numbers, one might expect that disclosure will ramp up in the following years, across all geographies. This is good: more transparency is welcomed and needed. However, as SCF Community, we offer a word of caution. Transparency for the sake of transparency is meaningless. Governance should be the objective, and transparency a component thereof. Hence, the question is whether the current normative pressures are a factor within a larger movement towards a governance model for the SCF industry. With that we mean a model that should…

- …include transparency and visibility among providers, rather than buyers only;

- …include a shared code of conduct for the industry, rather than sole dependency on accounting regulations;

- …be flexible and long-term oriented, thus adaptable beyond Supplier Financing, adaptable to whatever instrument (inventory, purchase order, deep tier financing) might be commonplace tomorrow;

- …be an instrument to actively avoid crises, such as Abengoa or the next Greensill.

Is this the case? Does the current movement towards transparency fit within building a larger governance structure? Or is it going to be a lone cry in the wilderness? We do not know, as the answer depends on all the SCF stakeholders; the entire SCF Ecosystem should be involved and take action to increase governance. Would any stakeholder think that accounting changes for buyers will suffice to avoid further SCF crises… you’d better think again. Never send to know for whom the SCF bell tolls: it tolls for thee.

Want to know more? We are going to talk about SCF disclosure in an open webinar on Thursday 21st of April, 2022, and share more data and information than in this article. Register for free here.

The webinar will be the opportunity to present our second publication in the series of SCF and ESG. For Governance, we review the transparency and visibility level in the SCF industry. The white paper will be downloadable for free during the webinar.

The other two papers in the series include the ‘E’ of ESG, which focused on reflections around sustainability inclusion in SCF programmes (available here), and the ‘S’ of ESG, which will focus on inclusiveness in SCF programmes (available in June). Stay tuned!